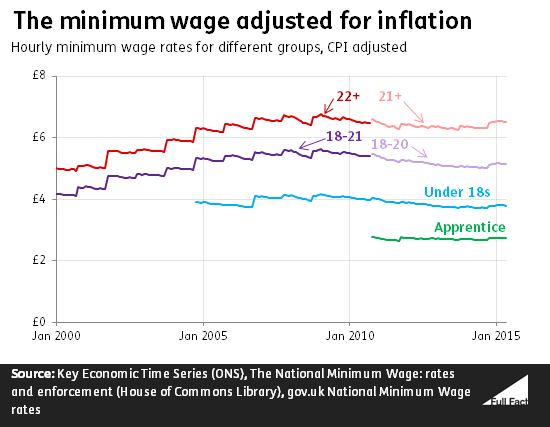

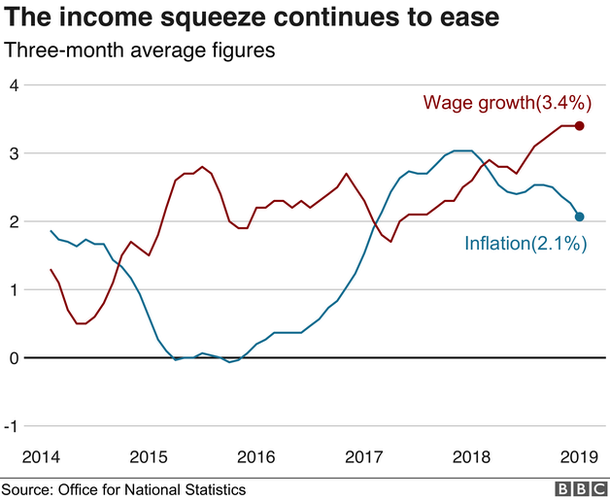

Minimum Wage Vs Inflation | Proponents of a higher minimum wage want to change all this by locking in wage increases for future years. Employers, especially small family and midsize businesses, will be disproportionately hurt by the extra costs incurred. Analysts in the financial sector have projected that the signing of the new minimum wage bill, a hike in energy tariffs and ongoing planting season would trigger a rise in monthly inflation rate in april, may and june this year even as inflation rate for march 2019 slowed down to 11.25 percent. That's as insignificant as leaving my tires at 29 psi vs. This is a persistent myth that lots of people have latched onto due to conservative propaganda. Raising the minimum wage has a number of serious and negative unintended consequences. (inflation is a choice of the central bank, set by monetary policy.) thus the answer to your question is. But despite massive grassroots efforts like the fight for 15 campaign, some are still. If you give employees, who also are consumers, more wages to spend on goods and services, that creates demand. In most cases, when those earning minimum wage earn more, higher paid employees are also given a raise. Proponents of a higher minimum wage want to change all this by locking in wage increases for future years. The minimum wage in the united states hasn't budged in 11 years. Raising the minimum wage does not cause inflation. If you give employees, who also are consumers, more wages to spend on goods and services, that creates demand. Minimum wage is related to the inflation rate, but they are two separate things. Analysts in the financial sector have projected that the signing of the new minimum wage bill, a hike in energy tariffs and ongoing planting season would trigger a rise in monthly inflation rate in april, may and june this year even as inflation rate for march 2019 slowed down to 11.25 percent. But despite massive grassroots efforts like the fight for 15 campaign, some are still. Employers, especially small family and midsize businesses, will be disproportionately hurt by the extra costs incurred. The federal reserve constantly monitors for inflationary risks to the u.s. Raising the minimum wage doesn't cause inflation. Nearly seven years after the federal minimum wage was raised to $7.25 an hour from $6.55, it has remained stagnant despite the increasingly heated debate over better pay and worker. The buying power of the federal minimum wage hasn't kept up with inflation, despite periodic increases. Minimum wage is related to the inflation rate, but they are two separate things. Whether it should was a hotly contested question during thursday's final when adjusted for inflation, today's minimum wage gives workers far less buying power than it once did. Though the minimum wage has risen incrementally over the years, it hasn't increased enough to account for inflation and the skyrocketing costs of living in many places across the us. It's important to compare real dollar values. What would have previously required going into substantial debt now appears to be mitigated by getting a roommate or taking on small debt, or getting some financial assistance. The local neighborhood stores and businesses with. Index to price inflation to guarantee the minimum wage can always afford the same theoretical basket of goods, or index to the increase in the median. Minimum wage is related to the inflation rate, but they are two separate things. If labour productivity is growing, with profit shares remain at high levels and underlying inflation within its target band. There are two common ways to achieve this: Finally, indexing the minimum wage to inflation might cause more problems than it solves. A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. 1adjusted for inflation, the federal minimum wage peaked in 1968 at $8.68 (in 2016 dollars). Proponents of a higher minimum wage want to change all this by locking in wage increases for future years. Raising the minimum wage does not cause inflation. While tackling the increase of the minimum wage. I look at the historical minimum here's a graphical representation of minimum wage in actual (dark purple) and inflation adjusted (light purple) dollars. If the minimum wage is indexed to inflation, there is a very real chance of exacerbating this problem. The argument that minimum wages do not increase inflation. For example, if in a city the average cost of rent is. Index to price inflation to guarantee the minimum wage can always afford the same theoretical basket of goods, or index to the increase in the median. Proponents of a higher minimum wage want to change all this by locking in wage increases for future years. Nearly seven years after the federal minimum wage was raised to $7.25 an hour from $6.55, it has remained stagnant despite the increasingly heated debate over better pay and worker. The minimum wage in the united states hasn't budged in 11 years. President obama called for a national minimum wage increase. In 2020, the department of health and human services set the federal poverty level at $26,200 for a family of four. Hope, by legislative fiat, to produce an increase in real wages beginning with the minimum, or is this simply a way of mandating a new inflationary spiral? Though the minimum wage has risen incrementally over the years, it hasn't increased enough to account for inflation and the skyrocketing costs of living in many places across the us. According to minimum wages vs unemployment so the result of an increased minimum wage is either higher inflation or higher unemployment both of which are components of the misery index thus increasing the minimum wage will most likely increase the overall misery of the country. Raising the minimum wage has a number of serious and negative unintended consequences. Since it was last raised in 2009, to the current $7.25 per hour, the federal minimum has lost about 9.6% of its purchasing power to inflation. Congress should increase the minimum wage annually to ensure it keeps up with inflation. Overall housing burden, all values in 2016 dollars. Raising the minimum wage doesn't cause inflation. Inflation means that prices are increasing everywhere. A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. More demand translates into companies paying higher wages and payroll taxes.

Since peaking 52 years ago, purchasing power minimum wage. The argument that minimum wages do not increase inflation.

Minimum Wage Vs Inflation: For example, if in a city the average cost of rent is.

Source: Minimum Wage Vs Inflation

EmoticonEmoticon